Why Can’t Finance Be Simple?

I just read a book called How Finance Works by Mihir Desai and I’m working on a summary and I opened up the book randomly and it’s p. 88, the part of the book where he has the title “Why Can’t Finance Be Simple?”

It was so perfect as I’ve been struggling to master the art of understanding finance, financial reports and so on. I’ve been struggling to summarize this book on Finance.

So I’m going to summarize this section, in hopes that it enlightens all of us and gives us that understanding that we need to create a better life for ourselves.

In his book he asks why can’t we just invest directly in companies themselves?

Why does there have to be such a complicated structure created in between investors and companies?

The answer is that

- investors don’t know if companies are telling the truth about their business and the benefits and downsides of investing.

- the owners of the company are also too far removed to know what the company is doing, and thus need finance to help understand what is happening in the company and be sure their managers are working ethically and professionally.

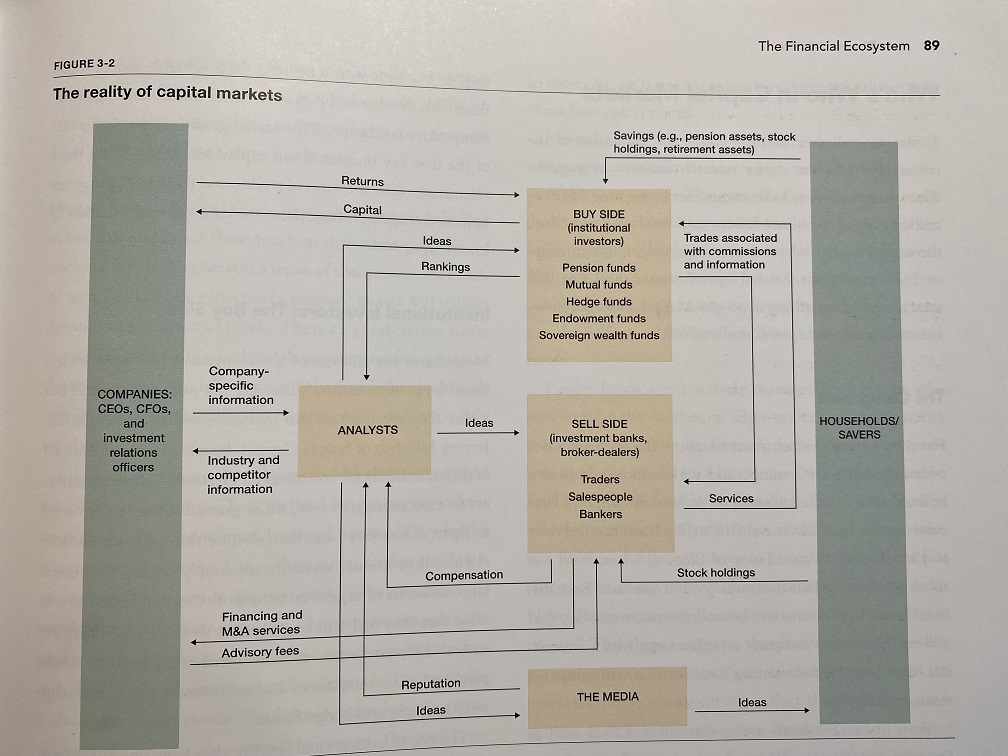

So, the chart above highlights all of the different yet important entities that have evolved in the world of finance to help connect investors to companies who need investment.

There’s the Buy Side and the Sell Side.

The Buy Side includes you and me, and mutual funds (passive or actively managed),

Financial Analysts get information from companies by visiting them, interviewing their CFO’s and writing up reports and giving companies investment grades (AAA or recommendations such as BUY, or HOLD, or SELL). The problem with financial analysts is that if they give a signal to sell, the companies they have relationships with may not want to talk to them anymore. In addition, it’s investment banks that hire financial analysts, and investment banks make money from the sell side.