The Language and Vocabulary of Money

Today we are going over the language and vocabulary of money.

Have you ever thought it was difficult to understand what people with money or work with money are saying?

Maybe it’s hard to understand your banker?

Or maybe the financial news sounds like a different language?

Well, it is a different language, with it’s own vocabulary.

I’m going to introduce you to the language and the vocabulary of money so that you can start to master money speak.

This is actually a key component to making you wealthier as well.

Words are the key to your success in any field, and that’s including the field of money!

Percent / Percentage / %

“by a specified amount in or for every hundred”

In number terms, let’s learn how to do percents, because most of my mastermind members don’t know how to do percents.

1 Percent = 1% = 1 out of 100 = 1 divided by 100 = 1/100 = 0.01

So if your savings account has $100 and makes 1% interest in 1 year, then you will make $1.00 in interest

Does this make sense?

Because 1 part in 100 dollars is 1 dollar.

This is how you would figure it out on a calculator 100 x 0.01 = 1

So it is important to know how to change a % into a number for a calculator. I usually just move the decimal point 2 places over from the right.

You can also just divide the percent by 100 on your calculator.

So 5% is 0.05 or 5% means 5 divided by 100 which equals 0.05

10% is 0.1

15.99% is 0.1599

Got it?

Here’s another skill that is so important – to figure out what percent you are paying or making.

For instance what percent of $1,000 is $22?

You calculate it by taking the amount in question and divide it by the total money invested or borrowed.

To change a decimal to a percent, multiply it by 100, or just move the decimal point 2 places to the right.

22 / 1000 = 0.022 = 2.2%

Here’s some percentage practice:

How much interest would you make in 1 year if you had a $10,000 savings bond that paid you 0.66% interest?

To answer this you would take the amount of the bond 10,000 and multiply it by the percent. If you see a percent, it means part of 100. In order to convert it into a number you need to divide it by 100, or move the decimal point over 2 places to the left. So 0.66% = 0.0066.

So 10,000 x 0.0066 = $66

You make $66 in interest from this savings bond in 1 year.

What if you just paid your credit card on the day it was due, and now you have a remaining balance (you still owe) $563 and the Daily Interest Rate is 0.299%. How much additional interest will you owe your credit card tomorrow?

563 x .00299 = $1.68

You would owe an additional $1.68 tomorrow.

If you bought a stock for $35 and it went up to $45 in a day, what is the percent it grew, or what is your percent profit?

So, first, calculate your profit by taking the total $45 and subtracting what you put in $35, which is $10.

$45 – $35 = $10 profit

Then divide the profit by the total invested to get the percent gain.

10 / 35 = 0.29 = 29%

You profited 29% in a day.

Now if you sell it you actually keep your profit.

If you keep your stock like most people and hope it shoots to $100, and then it just comes back down to $35 or less, then you didn’t make anything…or even lost money!

Principal

The money you invest, or the money you borrow.

So if you get a mortgage for $300,000, that is considered the principal.

If you put $100 in a savings account, the $100 is the principal.

Interest Rate

“the proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding”

If you have have a loan with a 5% interest rate, they will charge you 5% of your principal.

Here’s an example of how someone can be charged a fee based on an interest rate:

Let’s say you want to get your paycheck in advance from a pay any day lender at 12%.

If your paycheck is $1,256, then what is the 12% you will pay them and how much cash will they give you for your paycheck advance?

$1,256 x 0.12 = $150.72

So you pay them a fee of $150.72, which they subtract from your paycheck, which is $1,256 – $150.72 = $1,105.28.

Simple Interest

simple interest = principal x interest rate

So if you have a loan that charges you simple interest, and it is a 1 year loan, for $1,000, and the interest rate is 5.25% then you can calculate how much simple interest you will be charged in a year.

$1,000 x .0525 = $52.50

You will have to pay back the principal of $1,000 and the interest of $52.50 in a year.

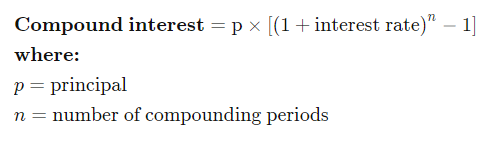

Compound Interest

Compound interest is what makes poor people millionaires in one lifetime, and also what makes many people stay middle class or poor for a lifetime.

The formula for compound interest is not easy to understand so I’m going to describe what compound interest is before I show you the ugly formula.

Compound interest is when you charge interest again and again over time, and the whole amount snowballs to get really big.

This can work in your favor, if you have savings or investments that are compounding.

It can also work against you if you have debts that are compounding.

It can work to the advantage of life insurance sales agents who show you how a whole life insurance policy can grow huge over time, even though it’s only making 3% interest per year over 20 years, and you’re paying him almost 99% commission on your money the first year.

So, here’s an example from investopedia:

The table below is an illustration of how compound interest works.

| Year | Beginning Loan | Interest 15% | Ending Loan |

| 1 | $300,000 | $45,000.00 | $345,000 |

| 2 | $345,000 | $51,750.00 | $396,750 |

| 3 | $396,000 | $59,512.50 | $456,263 |

| 4 | $456,263 | $68,439.68 | $524,702 |

| 5 | $524,702 | $78,705.28 | $603,407 |

| 6 | $603,407 | $90,511.07 | $693,918 |

| 7 | $693,918 | $104,087.73 | $798,006 |

| 8 | $798,006 | $119,700.89 | $917,707 |

| 9 | $917,707 | $137,656.03 | $1,055,363 |

| 10 | $1,055,363 | $158,304.43 | $1,213,667 |

| 11 | $1,213,667 | $182,050.10 | $1,395,717 |

| 12 | $1,395,717 | $209,357.61 | $1,605,075 |

| 13 | $1,605,075 | $240,761.25 | $1,845,836 |

| 14 | $1,845,836 | $276,875.44 | $2,122,712 |

| 15 | $2,122,712 | $318,406.76 | $2,441,118 |

| 16 | $2,441,118 | $366,167.77 | $2,807,286 |

| 17 | $2,807,286 | $421,092.94 | $3,228,379 |

| 18 | $3,228,379 | $484,256.88 | $3,712,636 |

| 19 | $3,712,636 | $556,895.41 | $4,269,531 |

| 20 | $4,269,531 | $640,429.72 | $4,909,961 |

At the end of 20 years, the total owed is almost $5 million on a $300,000 loan. A simpler method of calculating compound interest is to use the following formula:

Honestly, there are tons of compound interest calculators online that you can use to play around with some numbers.

The biggest ah hah moment for our mastermind is seeing how how you can grow an investment of $200,000 at 9.72% to $1,278,633.19 (we use the average rate of return from the all seasons portfolio recommended by Tony Robbins in his book Money Master the Game).

Are you starting to understand the power of compound interest?

Most savings account use compound interest.

Always be careful of borrowing money, and what kind of interest you will be paying.

At the same time, are you investing and taking advantage of compound interest?

Annual Percentage Yield (APY)

Investopedia states – “The annual percentage yield (APY) is the interest rate that is earned at a bank or credit union from a savings account or certificate of deposit (CD). This interest rate takes compounding into account. “

It is the rate you can use to see how much you will earn, or have earned, in one year if the money you invested stays put in the account.

APY is different from interest rate because it shows interest accrual percentage for a whole year.

Interest rate is a percentage earned, but it doesn’t say over what time period.

So, if you charge a friend 5% or $50 to lend them $1,000 and they pay you back the next day. And they do this every week for a year, what is your APY?

Well, that means you are investing $1,000 total and you made $50 a week x 52 weeks in a year so total interest is $2,600 in one year.

Take the amount of money you made and divide it by the amount you invested, and that is your APY.

2,600 / $1,000 = 2.6 = 260%

Now you know why pay any day lenders and loan sharks are in business and how much money they are making off their clients…if they get paid.

Annual Percentage Rate (APR)

Taken from Investopedia:

Interest rates on consumer loans are typically quoted as the annual percentage rate (APR). This is the rate of return that lenders demand for the ability to borrow their money. For example, the interest rate on credit cards is quoted as an APR. In our example above, 15% is the APR for the mortgagor or borrower. The APR does not consider compounded interest for the year.

Return on Investment (ROI)

Return on Investment or ROI for short means how much money are you actually making from the money you are investing.

I usually calculate it in terms of annual return, so I can compare it to the Annual Return on savings accounts and so on.

Annual Returns are stated as percentages. Glad you know what a percentage is now right?

If it doesn’t beat a savings account, then why bother?

So how do you calculate ROI?

If you bought a stock in the morning and it was $200, and now in the afternoon it is worth $223, what is the percent that your investment has grown?

So first figure out your profit.

$223 – $200 is $23 profit.

I then will annualize the number. If it took me a day to make the money, then I’ll multiply the profit by 365 days.

So 23 x 365 = 8,395

I then divide amount made in a year $8,395 by the amount invested $200.

8,395 / 200 = 41.975 = 4,197.5% APY

You might think that’s huge, and I say YES IT IS.

Think about it, if you put $200 in a savings account with an APY of 1%, how much do you make in a year?

200 x .01 = $2 for an entire year!

Now on the flip side, if you bought a stock for $200 and it dropped to $100 in a week, because of CoVid, and you cashed it out because you needed it to pay for food then you lost money…a lot of money because 50% in a day annualized is HUGE.

How huge?

100 is your loss so multiply it by 52 weeks in a year = 5,200.

5,200 / 200 = 26 or 2,600% annualized loss.

In terms of ROI you would say Negative 2,600% APY.

Annualizing profits and losses puts investments and losses into perspective.

If you want to see more ROI examples with Real Estate CLICK HERE for a property I analyzed and CLICK HERE for properties I analyzed with partner investment.

Index Funds

Index investing is nothing more than a strategy of buying a fund that holds all, or a representative sample of all, the stocks in a broad stock-market index.

From Investopedia – “An index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio constructed to match or track the components of a financial market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is said to provide broad market exposure, low operating expenses, and low portfolio turnover. These funds follow their benchmark index regardless of the state of the markets.”

Index funds with low fees are passively managed.

This means a computer just automatically makes sure all the stocks in the index fund or ETF are in the same percentages as the actual stocks in the index being followed (S&P 500 or whatever).

If you have an actually managed Index fund, then there is a person being paid to make decisions, and that is more expensive than a computer.

For more on Index funds from the guy who helped create them click here.

Brokerage Account

An account where you can buy stocks, bonds, options, etc.

There are many online brokerage Accounts which waive trading fees like Etrade, Schwab, WeBull, Robinhood, etc.

Passive Income

Money that your money makes for you, or investment income.

If you were on vacation for a year, this money would still come in.

This money will be passed on to your children or fund your foundation when you die.

Examples are savings account interest, dividends from stocks, growth in portfolio income, net rental income, business income from businesses that you own but don’t run, etc.

Financial Freedom

Though there are many definitions, T Harv Eker defines it as when your Passive Income equals or exceeds your expenses.

Hence you no longer have to work for money.

Expenses

Expenses is bills, and money you pay out to live your life.

Expenses include rent, groceries, phone, electricity, insurance, car insurance and fees, gas, etc.

Income

Income is money that you bring in through salary, gifts, allowance, commissions, sales, etc.

Balance Sheet

This is statement that shows how much you own, and how much you owe.

It’s the same as Net Worth.

For instance, you may own a car worth $6,000 and have a house worth $250,000, and $3,000 in your checking account.

That would be a list of what you own.

Car $6,000

House $250,000

Checking $3,000

Total Assets $271,000

Then you figure out what you owe:

Mortgage $200,000

Credit Card $230

Total Liabilities $200,230

The you subtract liabilities from assets for the difference. These lists and numbers are your balance sheet.

Income Statement

This is a statement of all of the money you bring in and all of the money you spend.

It is the same as Cash Flow.

You can do it on a monthly basis.

It could look something like this:

Income

Salary $2,500/mo

Expenses

Rent $1,200/mo

Electricity $60/mo

Groceries $400/mo

Auto $130/mo

Phone $50/mo

Restaurants $100/mo

Travel $100/mo

Shopping $200/mo

Net Worth

This is the same as your balance sheet, though if it’s 1 number then it refers to your assets – your liabilities.

So if you have $350,000 worth of stuff in cash and property (assets), and you owe $200,000 in debts (liabilities), then your Net Worth is $150,000.

Cash Flow

This is a statement of all the income you make and all of the expenses you pay.

When you subtract all of your expenses from your income, you get your cash flow.

So if you are making $3,000/mo and you spend $2,800/mo in expenses, you have a positive cash flow of $200/mo.

Assets

Banks have a different definition than we use here of what an asset is.

A bank will list anything that you own and its worth.

We will list things that you own that bring you money or passive income.

Robert Kiyosaki would say assets bring money in, and make you wealthy.

You want to have these.

Examples of assets would be:

Rental property that makes you money.

Savings accounts

Stocks

Bonds

Profitable Businesses

Liabilities

Liabilities are things that take money from you.

They are debts like credit cards, mortgages, car loans, rental properties that are losing money, etc.

Banks will list your debts and the amounts.

Robert Kiyosaki lists any thing that you own that takes money out of your pocket.

So the home you own is a liability because you spend money to keep it and live in it.

The car you drive is also a liability because you spend money to fill it with gas and maintain it.

This is where the definitions differ from a bank, since a bank would not consider your home or car a liability.