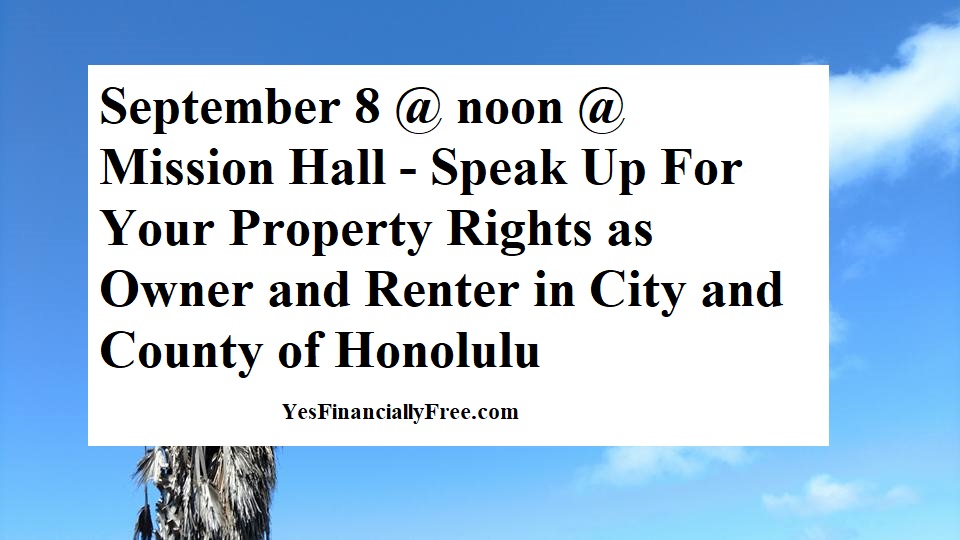

September 8 @ noon @ Mission Hall – Speak Up For Your Property Rights as Owner and Renter in City and County of Honolulu

You probably don’t know that there are revisions to Bill 89 being discussed that will affect all property owners AND renters in the City and County of Honolulu.

I spoke at a public hearing yesterday, as well as submitted written testimony in opposition of the revisions, and I strongly urge you to read this bill if you are a property owner OR a renter.

Here is the link to the bill – http://www4.honolulu.gov/docushare/dsweb/Get/Document-292713/08.30.31%20DPP_s%20Revised%20draft%20Bill%20(edits%20highlighted%20in%20yellow)%2c%20Transient%20Accommodations.pdf

You can find additional information about the proposed ordinance on the Planning Commission’s website and meeting agenda.

Here are instructions on how to speak at the next hearing on September 8, 2021 @ noon – Mission Hall or by computer or phone

To provide public comments during the online meeting via phone or Webex, you must first register by emailing info@honoluludpp.org with your name, phone number, and subject. Last time you had to register before 4:30pm on the previous day.

To join the public hearing from a computer: https://globalpage-prod.webex.com/join

Meeting Number: 123 096 9887

Meeting Password: dpp1

Join the public hearing from a telephone (audio only): 408-418-9388

Access code: 123 096 9887

Numeric meeting password: 3771

Here are instructions on how to submit a written statement –

Here is the website with the hearing details, links to all the documents being discussed, and other written statements already submitted.

I was told by my attorney that it is important to submit a written statement, with bullet points, on why you oppose the amendments.

Why This Bill Affects The Rights of ALL PROPERTY OWNERS AND RENTERS – SHORT TERM OR LONG TERM

There are 2 reasons this bill revision affects everyone, and not just me as a legally zoned tax paying AirBnB owner.

#1 The first is that it changes long term rental law so that you can’t rent out your property, or you as a renter cannot rent from a property, for less than 180 days.

Section 24. Chapter 21, Article 10 requiring rentals of less than 180 days to be transient rentals, unless it is a month to month continuation of a 180 day or longer lease

So if you are looking to rent a room, and want to rent month to month to see if you get along with your roommates, you can’t now.

If you need a place to rent for 4 months for a semester at UH, no can!

You want to visit your kids on mainland and rent your place, while your away? Not anymore.

I’m sure you can think of other reasons this is a violation of your property rights as an owner.

#2 If you are found to be guilty of renting for only 1 month up to 5 months, and are not registered to do so (which, if you live in a residential area, you can’t), then you are fined $25,000 per occurrence per day

Per Section 6, Article 2 of Chapter 21, Revised Ordinances of Honolulu 1990, if you are cited, you will be fined $25,000 per occurrence per day!

That’s the down payment on a house!

So if your auntie comes and stays with you for a month, and wants to return the favor by cleaning your house (a service or labor is considered rental payment), and your neighbor gets in a fight with your auntie and reports you, now you got to pay $25,000 and get your auntie out ASAP cause it’s another $25,000/day she stays.

You Have To Stand Up For Your Rights – Take Action

This was the first time I’d ever spoken at a public hearing.

I cried for two days and couldn’t sleep last night.

What is happening is not right. To me this is a fight for our FREEDOM.

Read the bill, and take action.

Say something.

Your Voice Matters.

Here is a sample of my written statement, which I wrote from the perspective of a legal short term rental AirBnB owner.

Aloha, my name is Meylysa Duldulao – M-E-Y-L-Y-S-A D-U-L-D-U-L-A-O and I am opposing the Proposed Amendments to the Short-Term Rental Ordinance Bill 89.

In preparing my statement, I called 3 insurance providers so far and none have been able to give me a quote for the $1,000,000 in commercial general liability insurance that this bill proposes that all TVUs and BnBs must have at all times. I wanted to know how much it would cost, and now I am finding it is impossible to comply with just 1 of the requirements in this revised bill.

As background, my husband Jomel and myself purchased 1911 Kalakaua Apt 608 in 2018. It was an existing AirBnB unit when we bought it. We continued using it as an AirBnB unit (https://www.airbnb.com/rooms/27395129). It is in a resort/mixed use district in Waikiki, and we have paid the property taxes in this higher bracket.

When we purchased the unit for an investment, we only looked at properties that had the proper zoning, as we wanted to follow existing laws.

Before purchasing the unit, we discussed with my mother, Theresa Tseng, if managing and cleaning the unit would be a good occupation for her. My mother just turned 70 years old this year, and has told me that over the past 10 years she has applied to many part time jobs and hadn’t found consistent work.

We pay her the cleaning fees for the unit, and she enjoys talking to the visitors who stay in our unit. She is also a Super Host, which is the highest status you can get on the AirBnB platform.

We are currently breaking even, and not profiting from our AirBnB business. With the added $5,000 / $2,500 renewal fee, we will be losing money and will probably have to close our business.

Though we average $3,500/mo, we pay the state $260.37 in property taxes, $358.75/mo in Transient Tax and$164.92/mo in GE taxes – totaling – $784.04 (22.4%). Eliminate the $5,000 registration fee/ $2,500 renewal fee for AirBnBs in resort/mixed use zones. Make a budget and justify it before setting aside any amount of money from property taxes, let alone the proposed amount, which is “up to $3,125,000.00 in real property taxes collected annually”.

I usually pick up my 8 year old son from school at this time, but my mother has helped me pick him up. I mention this because I feel this bill and the revisions hurt homemakers such as myself, and my mother, who raised 3 children. Now, with the added $5,000 registration fee/$2,500 fee. I have to figure out how to keep our AirBnB business from failing, which is my mother’s income.