How To Build an All Seasons Portfolio from Money: Master the Game by Tony Robbins

In this blog I will show you how to use the All Seasons Portfolio from Money: Master the Game by Tony Robbins.

Why do you want to learn about this portfolio?

Well, how would you like to invest your money and spend just an hour or two a year re-balancing it, and have it grow 9.72% net after fees are taken out? This is actual return, not an inflated average return.

It is called the All Seasons Portfolio because in the 30 years between 1984 and 2013, this portfolio has only lost money 4 times, and the worst loss was -3.93%!

Tony Robbins raves about it in his book Money: Master the Game, so let me tell you more about it’s awesomeness!

From 1984 to 2013:

1) You would have made money just over 86% of the time. There were only four down/negative years. The average loss was just 1.9% and one of the 4 losses was 0.03%.

2) Standard deviation was just 7.63% (This means extremely low risk and low volatility)

From 1939 to 2013 (75 years):

1) The All Seasons Portfolio lost money just ten times (slightly more than once a decade on average. The S&P lost money 18 times.

2) The largest single loss for the All Seasons Portfolio was -3.93%.

The largest single loss for the S&P was -43.3%.

3) The average loss for the All Seasons Portfolio was only -1.63%. The average loss for the S&P was -11.40%.

So what is the All Seasons Portfolio?

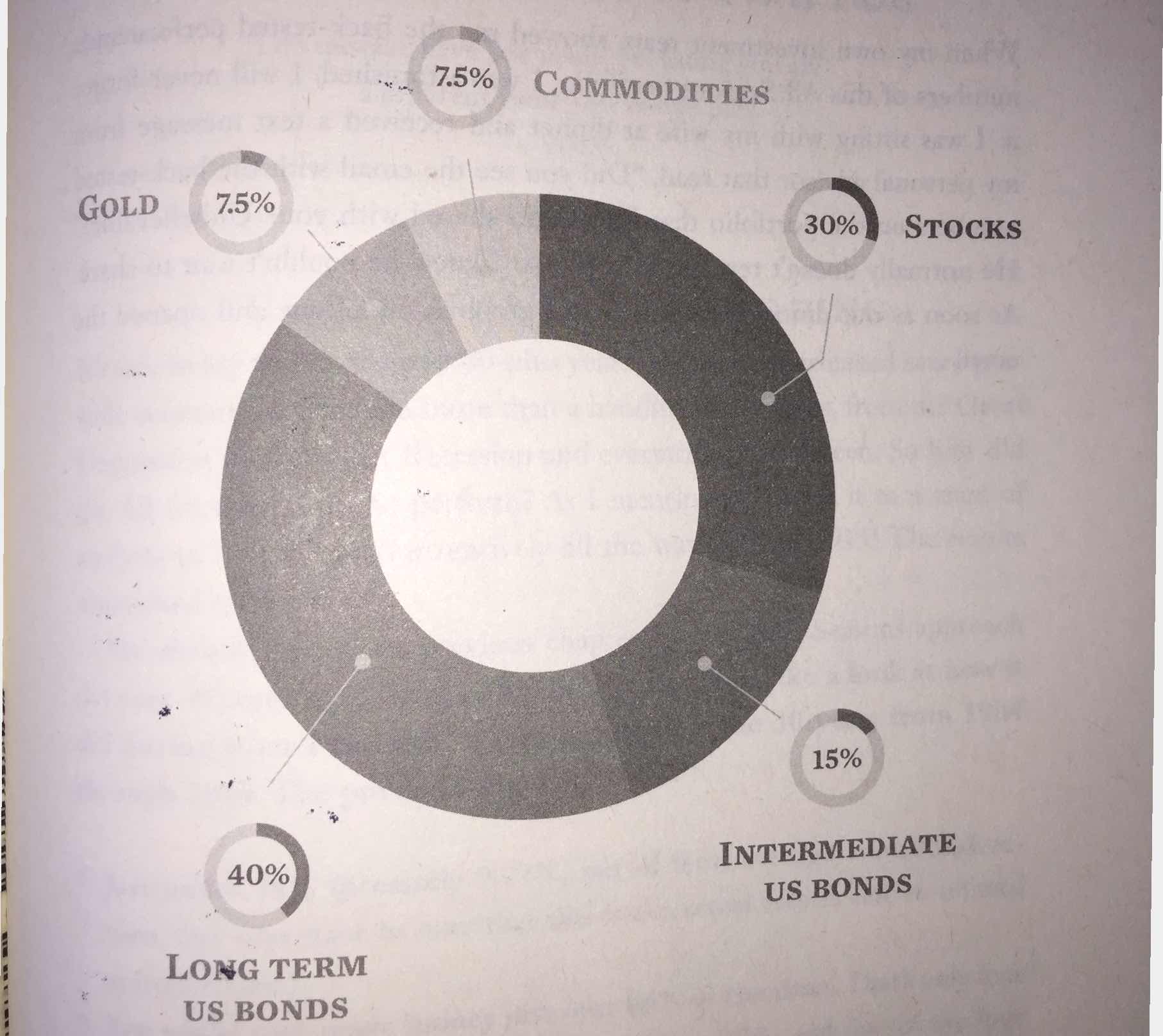

The All Seasons Portfolio consists of allocating your money to the following asset classes, taken from p. 393 in Money: Master The Game by Tony Robbins:

40% Long Term US Bonds

30% Stocks

15% Intermediate Term US Bonds

7.5% Gold

7.5% Commodities

For the stocks, bonds and commodities you can use low cost index funds.

You can buy gold or buy a fund that consists of gold holdings

So How Do You Re-Balance and Maintain the All Seasons Portfolio

You take the money that you are investing and you make sure it is divided up according to the percentages above.

Every year, you look at your investment, and you sell off anything that you have too much of to buy whatever you have too little of.

You can do this yourself and save yourself the fee to your financial advisor

I won’t take more than an hour or two once a year.

About Mey Duldulao

Back in 2011 I had over $30,000 in credit card and line of credit debt, was living paycheck to paycheck and was stressed out over my lack of success in my financial life.

In April of 2016, I became debt free and had a monthly passive income stream. I quit my job on December 23, 2016, and started doing my dream work of mentoring others on what I did to create the freedom to quit my job.

In 2017 we bought our first condo in Waikiki, and we went on 5 weeks of vacation (including a 7 day cruise to the Mexican Riviera)!!!

In 2018 we bought our first investment property and we converted our first condo into our 2nd investment property.

In 2019 we sold an investment property to buy our dream home steps away from Waikiki beach.

I spend most of my time doing what I dreamed of for years, spending my days with my son Jordan and my husband Jomel, enjoying motherhood and being a wife. I also enjoy researching Financial Freedom and sharing what I learn with my clients and on my blog.

If you want to learn more about how I can help take back control of your money and your time, then CLICK HERE, watch the free video and get started!