Dictionary of Investment Terms For Reading Income Statements and Balance Sheets

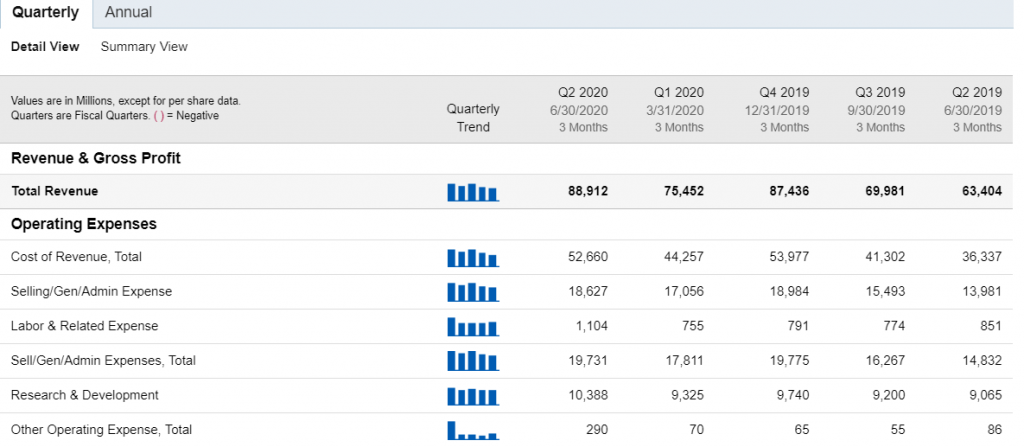

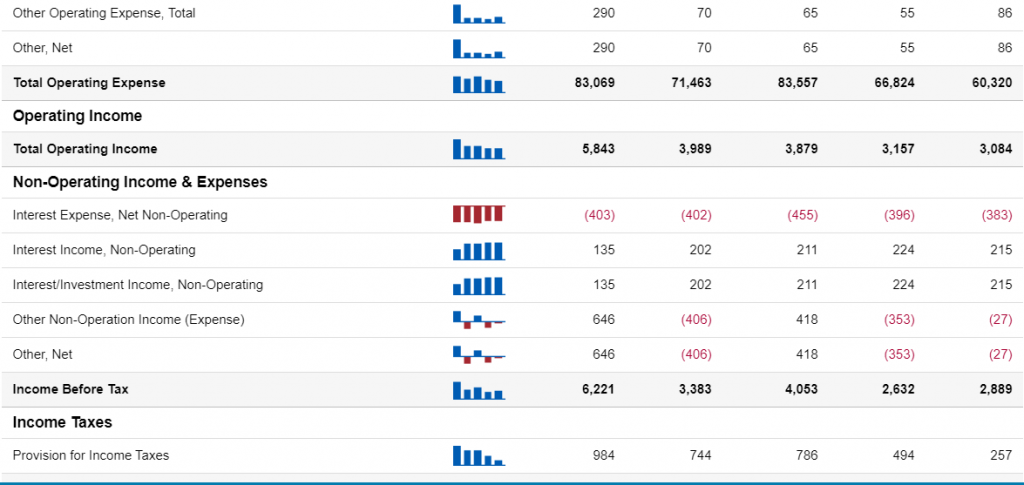

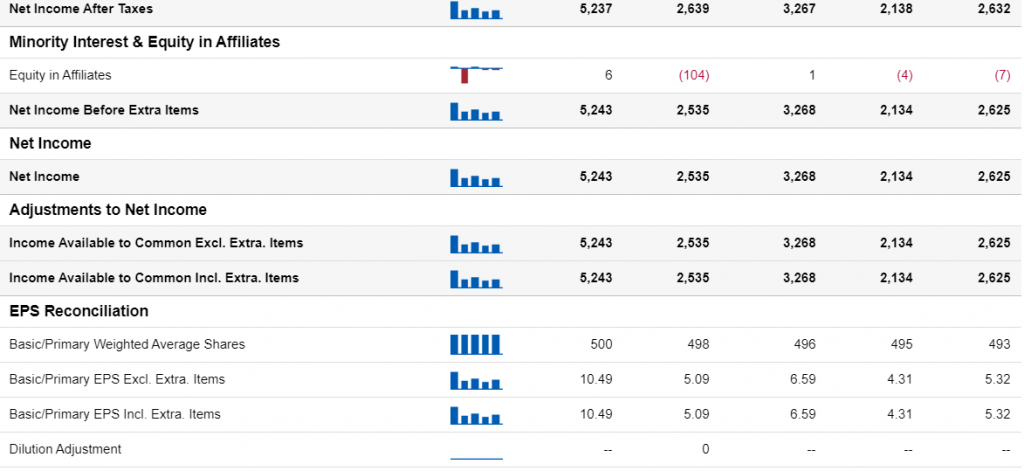

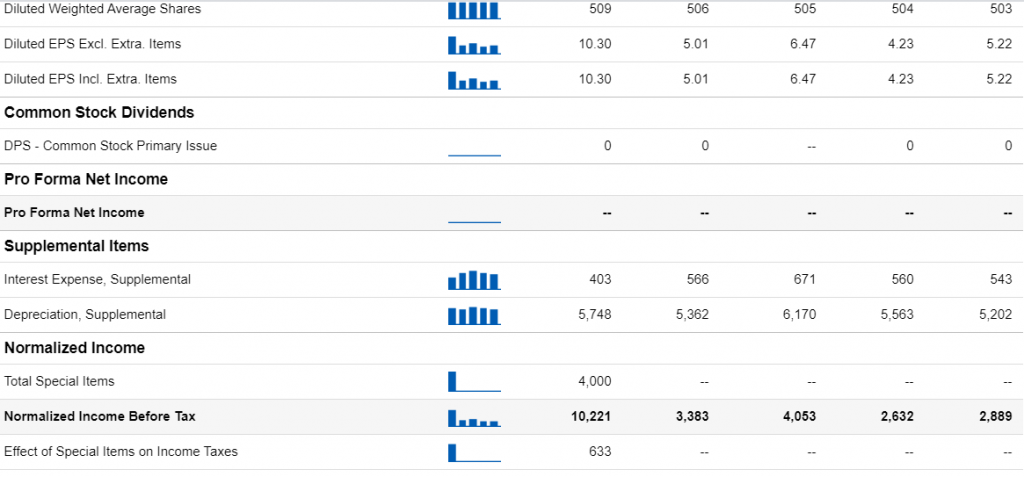

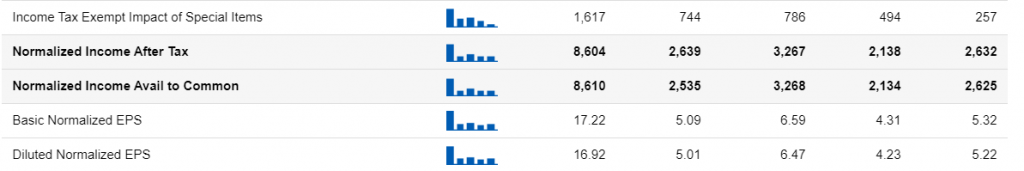

Below is the Income Statement for Amazon’s 2nd Quarter.

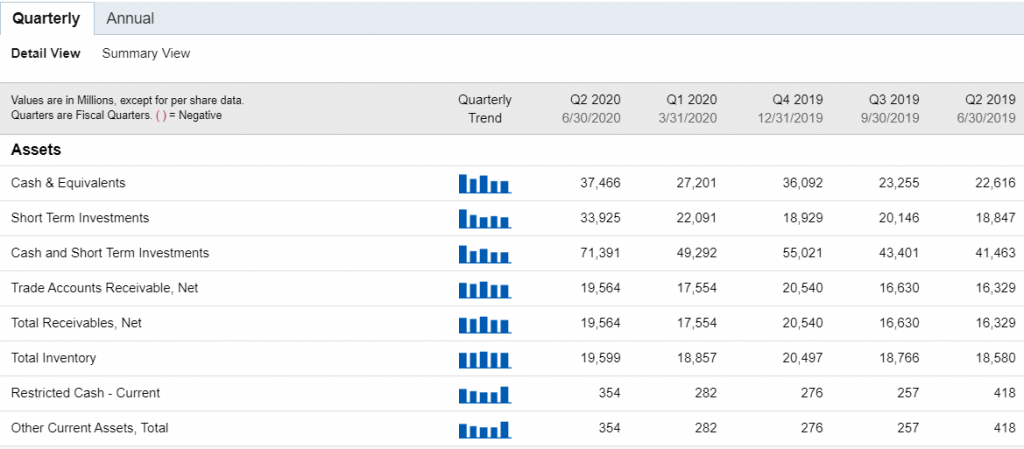

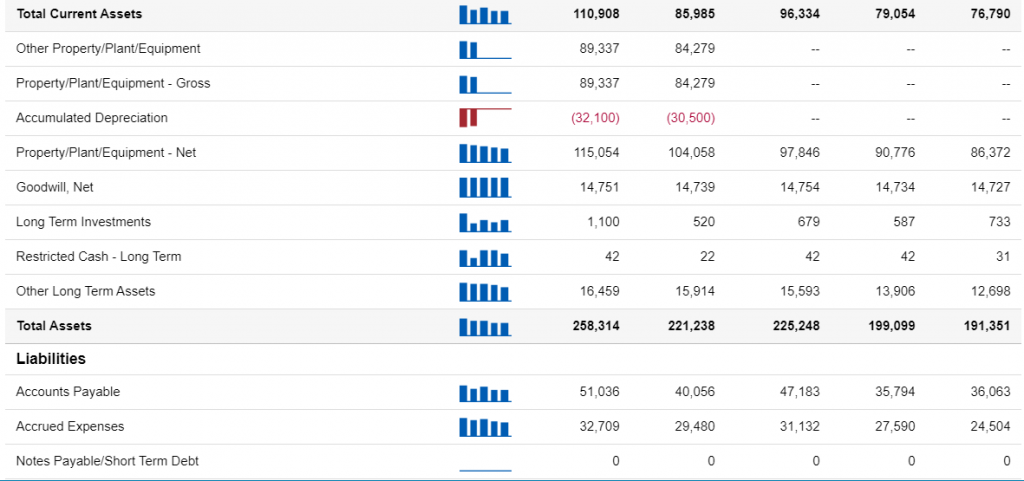

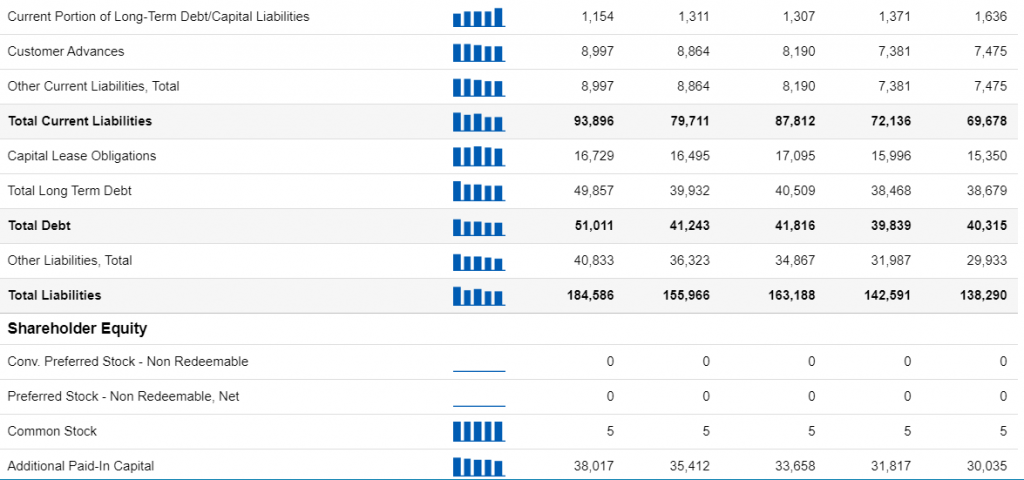

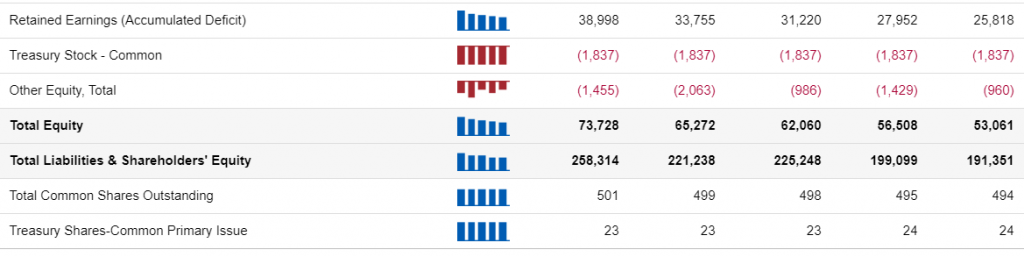

Next is Amazon’s Balance Sheet for 2nd Quarter 2020.

Goodwill – Goodwill is an intangible asset that is associated with the purchase of one company by another. Specifically, goodwill is the portion of the purchase price that is higher than the sum of the net fair value of all of the assets purchased in the acquisition and the liabilities assumed in the process. The value of a company’s brand name, solid customer base, good customer relations, good employee relations, and proprietary technology represent some reasons why goodwill exists.

Interest Expense, Supplemental – Interest Expense, Supplemental represents interest expense that may be paid and/or imputed, and are reported net of interest capitalized. When interest expense is not reported on the income statement, it is obtained from the notes of the financial statement.

What Is Capitalized Interest?

Capitalized interest is the cost of borrowing to acquire or construct a long-term asset. Unlike an interest expense incurred for any other purpose, capitalized interest is not expensed immediately on the income statement of a company’s financial statements. Instead, firms capitalize it, meaning the interest paid increases the cost basis of the related long-term asset on the balance sheet. Capitalized interest shows up in installments on a company’s income statement through periodic depreciation expense recorded on the associated long-term asset over its useful life.

Normalizing Adjustments to the Income Statement – Normalizing adjustments reveal the income stream available to the controlling interest buyer who will gain control over the income stream and who may be able to do other things with that income stream. They also reveal the income stream that is the source of potential value for the buyer of minority interests.