A Summary of The Intelligent Investor by Benjamin Graham

Join me live every weekday starting on April 9, 2020 as I read The Intelligent Investor by Benjamin Graham.

I will also be adding to this blog post a summary of each chapter as we progress through the book!

Chapter 1 Investment versus Speculation: Results to Be Expected by the Intelligent Investor – goes over the difference between a speculator (gambler) and an investor. Basically, if you are investing your money in a way that it conserves principal and grows at a profit then you are an investor. If you are not, then you are gambling with your money.

Chapter 2 The Investor and Inflation –

Chapter 3 A Century of Stock-Market History: The Level of Stock Prices in Early 1972 –

Chapter 4 General Portfolio Policy: The Defensive Investor –

Chapter 5 The Defensive Investor and Common Stocks –

Chapter 6 Portfolio Policy for the Enterprising Investor: Negative Approach – goes over what an aggressive investor should avoid:

- Don’t buy high-grade preferred stocks because they are only cost effective for corporate buyers

- Don’t by inferior types of bonds or preferred shares unless you can buy them at bargain levels of at least 30% below par for high-coupon issues (high interest/return)

- Don’t buy government bonds

- Don’t buy new issues, including convertible bonds and preferreds and common stocks with excellent earnings only in the last couple of years.

He then goes into a lengthy discussion of how bull markets occur when people are buying these types of securities, and bear markets are when they lose a lot of their investment money.

Chapter 7

Chapter 8

Chapter 9 Investing in Investment Funds – Discussed mutual funds. They returned average results on par with the S & P stocks and he believes that investing in mutual funds is wise for average investors, who need help with regular savings and also to prevent them from trying to invest money on their own and gamble their money away.

Performance funds did much worse than regular mutual funds, because they are run by young inexperienced investors with hot streaks that take too many risks.

Closed-end funds were formed a long time ago, have a fixed capital structure.

Open-end funds are growing and have sales people selling them for commissions.

When buying the fund, you can find out if it’s selling at a discount or a premium. A discount means that the stock holdings are worth more than what the fund is selling at. A premium means that the stock holdings are worth less than what the fund is selling for.

Closed-end funds bought at a discount tend to perform better than open end funds bought at the same discount, due to the fact that you don’t have to pay a salesperson’s commissions.

They recommend against investing in bond funds, and just to invest in bonds directly with the U.S. Treasury.

Chapter 10 The Investor and his Advisers – discusses the various ways that investors get advice and the inherent problem of asking advice from others on how to make money.

“Businessmen see professional advice on various elements of their business, but they do not expect to be told how to make a profit. (p. 131)”

He does recommend to invest money with very conservative and well known firms in a very boring and conservative method, as a means of protecting the average investor from losing money trying to do it themselves.

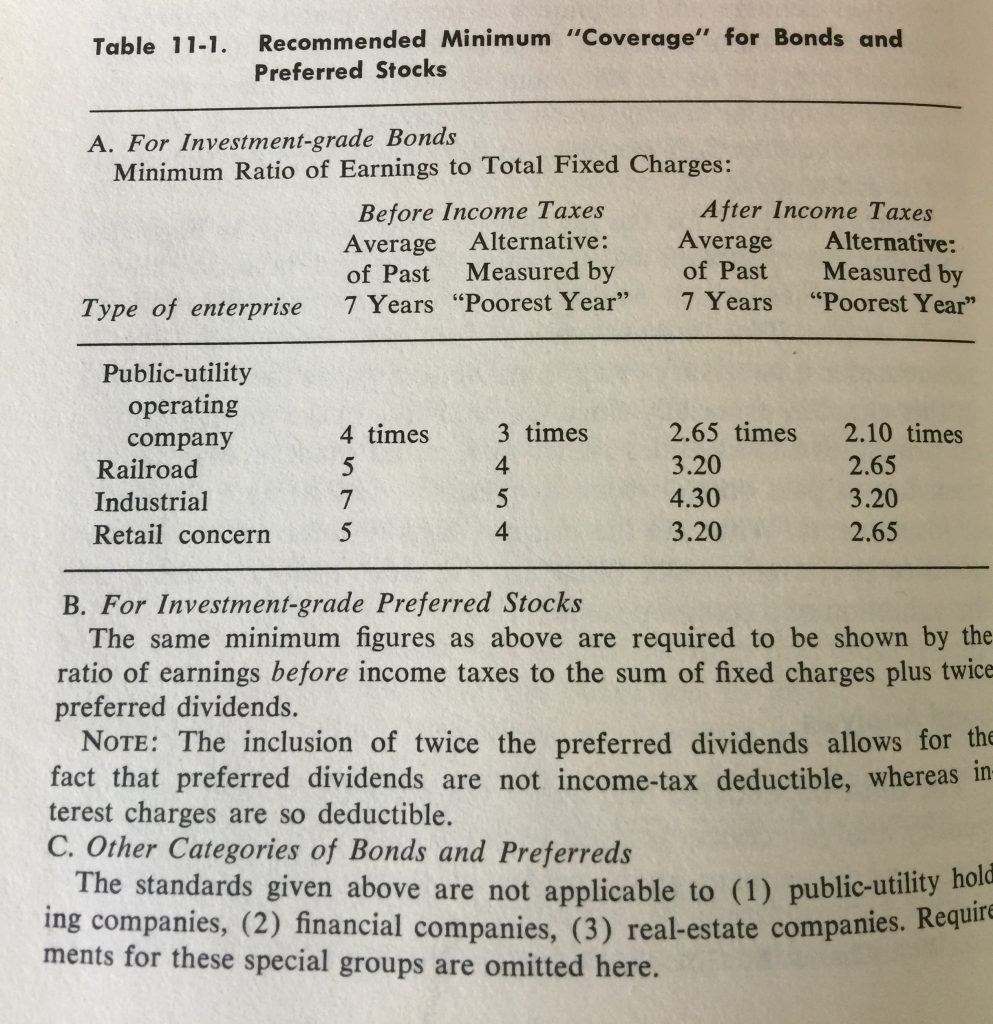

Chapter 11 Security Analysis for the Lay Investor – They give some methods they use to figure out if a bond, preferred stock or common stock is worth buying or selling.

They give the recommended minimum “Coverage” for Bonds and Preferred Stocks on page 148. If the bond or preferred stock meets the required coverage, then it is relatively safe to invest in it.

They also give a formula for determining the value of a stock:

Value = Current (Normal) Earnings x (8.5 plus twice the expected annual growth rate)

The formula of course doesn’t work that great, but they say that it’s better than any other formulas used out there now.

They don’t show how to calculate the expected annual growth rate.

Feel free to leave your comments below, share this with your friends and followers and join the e-mail list by writing your name and best e-mail address on the right column of this blog.